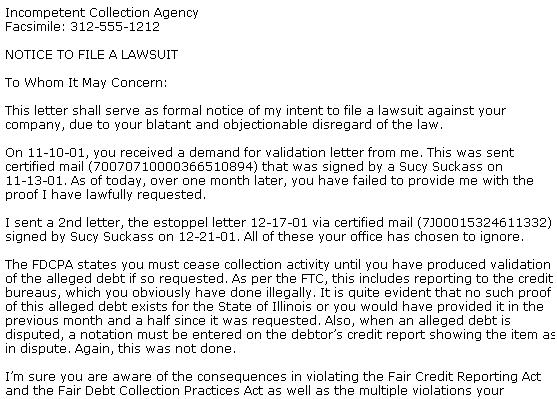

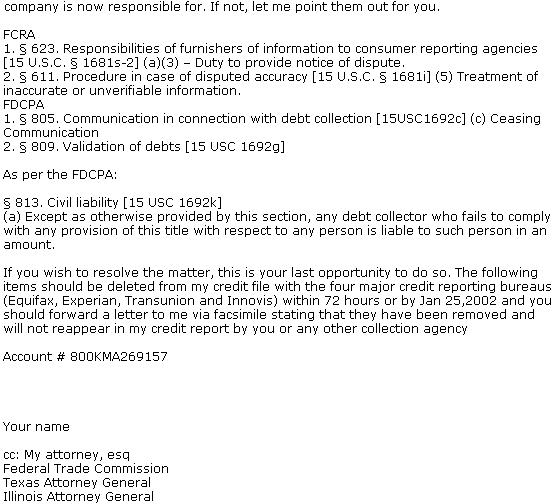

Intent to sue sample letter

I noticed an intent to sue letter. Here is the one I use. Enjoy

:D

I noticed an intent to sue letter. Here is the one I use. Enjoy

:D

A Debt Validation Follow-up Letter is sent to the collection agency when they fail to respond to your debt validation request. It is a way to remind the debt collector of your initial validation request. You can use this letter only if you had previously sent a debt validation letter to the collection agency. This letter can also help you get rid of the item if not validated.

Sample Debt Validation Follow-up Letter

I have a couple questions/ starting points,

1) who made the mark on your CR was it a CA or the OC?

2) can you get in writing the dates that the office was in network and the dates they were out of network?

3) send the doctors office a written request that your chart and all documents signed by you, to be sent to you.

4) write down in detail as much information as you can remember. Receptionsist names, dates etc. Call your insurance company again and find out why they suspended that office for that time period.

This letter should only be used after the proper court procedure has been followed. You must notify the credit bureau you are suing them by serving them with a Summons and Complaint.

Your name:

Address:

CRA name:

CRA address:

Dated:

Re: Account number

Dear Sir/Madam,

This letter is to further notify you that a lawsuit has been filed against you at [name the court] on [date]. An additional copy of the Summons and Complaint is attached. The case number is_______.

You can send a Cease and Desist letter to the collectors requesting them to stop calling you. Below is a Sample Cease and Desist letter (CND letter).

Your Name __________

Your Address __________

Your Phone # __________

Collector's Name _______________________

Collector's Address _____________________

Date ________________________

Dear Sir or Madam,

Re: Account Number ____________

Your full Name:

Your permanent address:

Present contact number:

Name of credit reporting agency

Address of credit reporting agency

Dear Sir or Madam,

I would like to dispute some inaccurate information I have discovered on my credit report. The items I believe to be incorrect are listed below. I am also including a copy of my credit report with the disputed information highlighted.

Please put your valuable vote in here.

What is a Pay for delete letter?

A Pay for delete agreement is normally made with the original creditor or a collection agency (CA) to remove an outstanding debt listing from your credit report.

If the name of the creditor or the CA gets listed in your credit report with a particular debt, you should first ask for debt validation by sending a Debt Validation (DV) letter to the creditor. Once your debt gets validated by the creditor, you need to send a Pay for delete letter.

<Company>

Date:

Re: <Your>

Dear Sir/ Madam,

This is to inform you that I have been unable to make payments on time for the past [insert number of months] months due to [insert reason for late payments]. My earlier payments have always been on time. I have been successful in recovering from [insert reason for late payments] and am now capable of paying back the debt.

What is debt validation?

Debt validation is the debtor's right to ask for validation of a debt a creditor claims he owes. A letter requesting validation of the debt should be sent to the creditor or the collection agency, if they claim that you owe the debt, either by sending a collection letter or by reporting the debt on your credit report.